These resources offer support from startGBC collaboration partners.

startGBC Collaboration Partners

Government of Canada

Support for your business. You can search this portal for available grants.

City of Toronto

Funding for Small Businesses:

For entrepreneurs looking to start a business in Toronto, there are over 60 business incubators and accelerators providing support for a range of sectors, from digital media and healthcare to food processing and retail. Business support programs are offered across the country and are tailored to specific industries, demographics, or special economic purposes.

Below you can find various financing options for small businesses in Toronto. For additional information, you can also generate a tailored list of government financing programs for your business using Innovation Canada’s interactive tool or visit Government of Canada for more information on business grants, loans, tax credits, wage subsidies and other government financing.

Fundingportal

Fundingportal is a funding services and solutions provider that helps organizations get funded. Its unique Fundingportal GMS (Grants Management System) Software as a Service (SaaS) solution powers its own platforms—Fundingportal Canada, US and UK—and is offered as cloud-based solutions to applicants, funders, and advisors. Founded in 2011, it has served more than one million users on its platform and has licensed its solutions to dozens of licensees, including business incentives advisory firms, economic development agencies, industry associations, and accelerators.

Grant Connect

Grant Connect helps over 1,000 non-profits find funding.

The Grant Connect site is only available for public use at George Brown College Library Learning Commons (if a current student) at https://grantconnect.ca/search or through this link from Toronto Public Library https://grantconnect.ca/login

Access Community Capital Fund

Affordable. Non-Profit. Character-based lending.

We offer loans to people with poor or no credit, no collateral, or anyone who’s unable to get a loan from a major bank. We use a character-based lending model, which means we consider your character, skills and motivation when you apply.

Rise Asset Fund

Empowering people, Launching ideas.

Rise helps those with mental health challenges realize their small business ideas. Rise is the only national charity that provides people with a history of mental health or addictions a path toward sustained self-employment through training, resources, mentorship, and low-interest microloans.

Your support is vital to realizing our vision of establishing a coast-to-coast network of program sites spanning a diverse mix of urban and rural communities. The Rise brand will be recognized as Canada’s leader in entrepreneurial education and start-up financing for people with mental health and addiction issues.

Rise offers loans up to $10,000.

Futurpreneur Canada

Futurpreneur Canada has been fueling the entrepreneurial passions of Canada’s young enterprise for two decades. We are the only national, non-profit organization that provides financing, mentoring and support tools to aspiring business owners aged 18-39. Our internationally recognized mentoring program hand-matches young entrepreneurs with a business expert from a network of more than 3,000 volunteer mentors.

Business Development Bank of Canada (BDC)

At BDC, we know business owners. We’ve been working with them for 75 years. We know their challenges, and we understand their needs. And we want them to grow and succeed.

We support small and medium-sized businesses in all industries and at every stage of growth with money and advice. We are the Business Development Bank of Canada. We are BDC.

Ontario Catapult Microloan Fund

The Ontario Catapult Microloan Fund enables social entrepreneurs and innovators to grow their world-changing enterprises with access to capital and CSI’s existing programming and services. The fund has made $355,000 in loans so far.

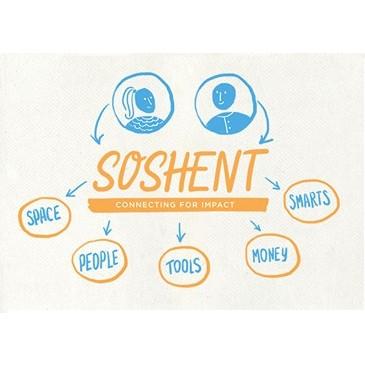

Soshnet

Soshent connects social entrepreneurs & innovators to the programs, opportunities and funding they need to accelerate their success and amplify their impact.

Ontario Creates

Ontario Creates, an agency of the Ministry of Heritage, Sport, Tourism and Culture Industries, is the central catalyst for the province’s cultural media cluster, including book publishing, film and television, interactive digital media, magazine publishing and music industries.

Ontario Creates promotes, enhances and leverages investment, jobs, and original content creation.

Pocketed

Pocketed is a powerful grant-matching platform designed to do all the heavy lifting for you. Our grant platform is completely free to use (unlike the other grant guys). Pocketed makes grant funding more accessible to every business owner. Impactful funding, right in your back pocket.

Ontario Summer Company Program

Start a summer company: students

Through a program called Summer Company, you can get:

- start-up money to kick off a new summer business

- advice and mentorship from local business leaders to help get the business up and running

Learning how to run your own student business is one of the best summer jobs you can have. You get to be your own boss while learning what it takes to manage a business. Sales, marketing, bookkeeping, customer relationship management and networking are just a few of the highly useful skills you’ll develop.